The prices of equipment financing will often be decrease than other flexible financing possibilities. But don’t think that’s the case. One example is, you may be able to pick up a superb bit of utilised equipment in a bargain cost, pay back with it employing a very low-price business credit card, and come out in advance.

Private loan. Mainly because they do not have a time-in-business or revenue need, personalized loans is often yet another way to finance your obtain, especially if you can obtain a competitive fee.

If you default to the loan, then the lender will seize the equipment and Recuperate losses around the remaining worth. Because of this, you might not must sign a personal assurance or present further collateral.

We’ve presently discussed the advantages and drawbacks of equipment loans, so Allow’s assessment some advantages of another two solutions.

Explore much more automobile insurance coverage resourcesCompare car insurance policy ratesBest automobile insurance policies companiesCheapest vehicle insurance coverage companiesCar insurance reviewsAuto insurance plan calculator

Then again, In the event the business will take on payments for equipment that doesn’t make earnings, that more expense can damage funds flow. Equipment normally depreciates, and might be not easy to offer when it’s now not desired.

We try to provide you with specifics of services and products you would possibly find interesting and handy. Romance-dependent advertisements and on-line behavioral advertising and marketing enable us do that.

I really hope this information has long been useful for you as you consider SBA loan selections. how can i get a loan for my small business When you have any issues, please Be at liberty to succeed in out And that i might be satisfied to test to assist!

To find out more about advert options, or to opt out of desire-based promotion with non-affiliated third-bash web pages, stop by YourAdChoices layer powered through the DAA or with the Network Advertising and marketing Initiative's Choose-Out Instrument layer. You might also visit the person websites For added information on their details and privateness procedures and choose-out solutions.

What exactly is an equipment loan? How to get equipment financing Routinely asked thoughts Vital takeaways There are three major choices for financing business equipment: a loan, a lease or sale-leaseback Lenders could offer you versatile repayments, aggressive curiosity charges or large loan quantities, so it’s imperative that you Evaluate many lenders Lenders wish to see good to solid credit score, nutritious revenue and a longtime business, while some equipment lenders are lenient with their eligibility specifications Equipment loans are a superb source when your business requires equipment it may possibly’t buy outright.

Nevertheless, this does not influence our evaluations. Our opinions are our personal. Here is a summary of our partners and here's how we earn a living.

With an equipment lease, regular monthly payments are typically smaller than loan payments. Moreover, no down payment is frequently expected, but you don’t personal the equipment Until you opt to get it at the conclusion of your lease.

Assuming that the laundromat idea is suitable for an SBA loan, Allow’s take into consideration why an SBA loan might be a good in good shape for your business upcoming.

A business equipment loan isn’t for everybody. You may need a big down payment and good credit score to qualify. Financing business equipment is, needless to say, more expensive than paying for it with hard cash.

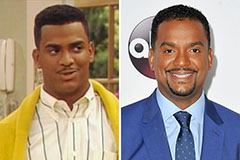

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!